- Joined

- 26.12.23

- Messages

- 248

- Reaction score

- 13,784

- Points

- 93

? Dispelling Some Common Carding Myths ?

I see it every fucking day - newcomers waddling into forums clutching the same recycled bullshit they found on some sketchy Telegram channel. While these poor bastards are busy chasing ghosts actual carders are laughing all the way to their crypto wallets. Time to take a sledgehammer to the myths that are probably destroying your success rate right now.

The "Clean IP" Fantasy

Youve heard it a thousand times: virgin IPs are magical talismans that guarantee approvals, and anything "dirty" gets you instantly rejected. What a load of horseshit.

While 'clean is somewhat useful it's not the holy grail Telegram dwellers make it out to be. A lot of times the dirtiest, most flagged IPs work better than your precious "clean" ones. Mobile carrier IPs and iCloud Private Relay addresses throw red flags on paper but no merchant can afford to block them without committing financial suicide.

Entropy is your best friend. Anti-fraud systems must balance catching fraudsters against blocking legitimate customers. When an IP is shared among thousands of users, the system faces an impossible choice:

- block it and lose millions in revenue

- or accept the noise and let some fraud slip through

Meanwhile those "pristine" datacenter IPs you're paying premium for? Advanced antifraud systems have already cataloged them. They stand out precisely because theyre too clean - lacking the organic patterns that legitimate connections have. And they often already have bad records on Radar and other antifraud providers anyway.

Sometimes it's better to hide in plain sight with mobile data or Relay than use overpriced "clean" proxies. The crowd provides better cover than isolation ever could.

The BIN Delusion

GET YOUR CARDS HERE

Forums are crawling with newbies hunting for that mystical six-digit combination that supposedly bypasses all security. Some idiots actually pay for these "magic BINs" in Telegram groups, begging "Drop your working BINs!" as if some secret number sequence is their ticket to unlimited approvals.

BINs arent magical keys. They're one tiny data point in an ocean of signals. Risk models, 3DS protocols, velocity checks, device fingerprinting, and shipping patterns all carry more weight than those first six digits youre obsessing over.

Hammering the same "working" BIN is digital suicide—you're spoon-feeding the machine learning exactly what to flag next. Transaction coherence matters more than any magic number sequence.

Your device fingerprints, AVS matching, and realistic purchase patterns will get you further than the hottest BIN list ever could.

KYC Paranoia

Carders worry that doing verification selfies means some employee will save their photo and remember their face. This misunderstands how modern KYC works.

Todays KYC systems are primarily automated. Your facial image gets converted into mathematical data points. Companies never actually save your original photos/selfie videos and they only keep the mathematical representation. Human review only happens when the system flags serious inconsistencies, and even then these system typically request further documents while reviewers process hundreds of verifications daily with no way to remember individuals.

"Liveness checks" simply confirm you're physically present during verification rather than using a printed photo. Your focus should be on consistency across verification materials - matching lighting, camera angles and ensuring metadata alignment. This matters far more than worrying about someone memorizing your face.

This doesnt mean you should plaster your face across every crypto service to card $20 worth of ETH. Unless you have a twin, your likeness is yours only. So keep it safe.

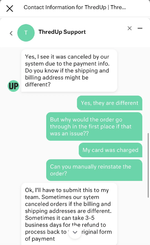

The Verified Shipping Address Myth

"Banks verify your shipping address with every transaction" - this misconception has cost carders countless opportunities. Truth: For Visa Mastercard, and Discover banks only see the billing address through cards that support AVS. The shipping address is never transmitted to the issuing bank.

American Express has an AAV/AAV+ system where cardholders can register alternate addresses, but few merchants implement this outside luxury goods and travel sectors. Some older merchants might call the bank for manual verification but this rarely happens nowadays due to the sheer volume of transactions and the multiple layers separating retailers from banks. Only merchants selling ultra-premium items worth the hassle and expense still bother with this dinosaur of a security measure.

While 3DS 2.0 systems can include shipping data in risk assessment, banks don't directly approve or deny transactions based on shipping addresses alone. The real verification happens on the merchant side through antifraud rules and analysis of previous orders.

When you get messages telling you to "add your shipping address to your card on file" understand whats happening. These aren't literal instructions - theyre generic rejection messages saying "your order failed our fraud checks."

Beyond the Mythology

Fairy tales are expensive in this game. The fraud prevention system you're up against has multiple layers: network rules, issuer AI merchant security stacks, shipping intelligence and behavioral analytics. Banking on simplistic "solutions" is why amateurs rage-post instead of counting profits.

Master the entire ecosystem, test systematically and adapt constantly. When someone sells you their "100% guaranteed method," remember: if it actually worked flawlessly they'd be exploiting it silently—not hawking it to strangers for pocket change.

In this game, your bullshit detector is your most valuable asset. Sharpen your critical thinking before you sharpen your tools, and you might just survive long enough to make some real money. d0ctrine out.

Last edited: